We have seen floods, earthquakes, storms & fires. Where the NZ financial industry has taken some great steps towards addressing climate change events and associated risks.

Let's see what's been happening recently...

- Investment Activity: Rise of climate-related funds & consumer expectations.

- Law Reform: Financial Sector (Climate-related Disclosure and Other Matters) Amendment Bill.

- Contract Development: Chancery Lane Project's development of climate-related clauses.

Why is there a rise in climate activity by funds & investors? How much of climate response is driven by consumer expectation?

Climate Focused Funds & Managers: There are now many climate-related funds and managers such as NZ Green Investment Finance, Climate Venture Capital Fund, Impact Enterprise Fund, ACC, NZ Super Fund, Harbour Asset Management, Salt Funds Management, Mint Asset Management, Russell Investment NZ and Southern Pastures (and that’s just NZ alone!).

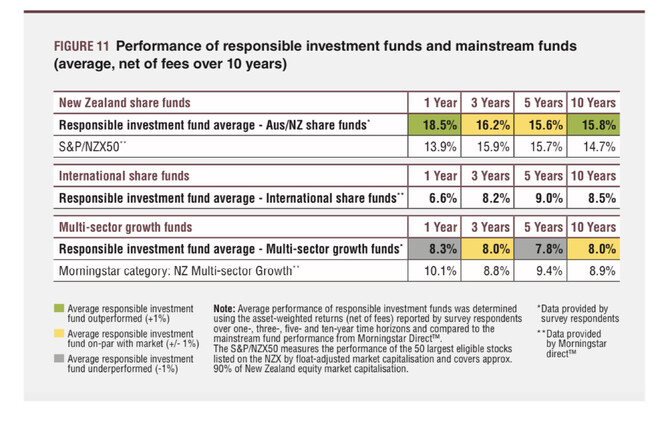

Strong Returns: The Responsible Investment Association Australasia (RIAA) have just released their RIAA 2021 Report that shows responsible NZ investment funds have produced an average return of 16.2% over 3 years and 15.8% over 10 years. This compares with returns of 15.9% and 14.7% respectively for the S&P/NZX50 index (see figure below extracted from RIAA 2021 report).

This tells us that on average responsible investment funds are performing the same if not better than the those top 50 companies listed on NZ's stock exchange.

Consumer Expectations

Two common themes that appear to be communicated to climate-focused investors address the following:

Investment Decisions: Whether investments will be made with the following in mind:

- Renewable energy

- Energy efficiencies

- Low carbon

- Biodiversity conservation

- Health waterways

- Sustainable land

- Water management

Risk Management: Whether businesses can identify foreseeable climate change risks to the business (including risks faced by the business' suppliers and distributors) and manage any legal, financial and commercial impacts of climate change events on the business.

Financial Sector (Climate-related Disclosure and Other Matters) Amendment Bill

Proposed Law For 2022: Now in its second reading (meaning the House of MPs is still debating the select committee report), this proposed new law will require certain businesses to disclose how they are dealing with climate change. It's for the big 200 or so businesses in NZ (i.e. NZX companies, banks, insurers and registered investment schemes).

Relevance for Smaller Businesses: Besides the chance that climate disclosure rules may trickle down to all businesses one day, businesses may choose to disclose just to keep up with consumer demands and expectations. We're already seeing plenty on websites and information memorandums.

If this law passes, the disclosure documents released by the larger companies can provide a great precedent for businesses to see how to assess the risks of climate change and how they can communicate that to their stakeholders.

Chancery Lane Project - Climate Clause Development

Chancery Lane Project: Around 700 contract lawyers worldwide have come together on the Chancery Lane Project to prepare clauses supporting climate change. These clauses are applicable to all sorts of industries, including the financial markets. Their website has many great contract provisions (publicly available) and is worthwhile to check out.

Some interesting clauses from the Chancery Project include:

- New Boilerplate: A separate boiler plate from Force Majeur that is more specific to climate events.

- Definitions: Defining what is climate change or a climate event.

- Risk Sharing: Recording how parties may share risk (i.e. costs) when there is a climate event.

How quickly will climate change clauses take off in NZ? We’ll see, however climate themed awareness, activity & assessment is certainly growing.

Please reach out to Janey at janey@jhlaw.nz if you have any questions regarding the above. The above is purely for informational purposes, where JH LAW will need to determine if the above information is applicable or appropriate to your particular situation.